April 2024 Market Report 🏡

As of December 1st, Ontario's real estate landscape is undergoing a transformation through the implementation of Phase Two of the Trust in Real Estate Services Act (TRESA), replacing the previous REBBA. This signals a significant shift in the conduct of real estate transactions, impacting almost 100,000 realtors in Ontario. At The Olivera Group, we are dedicated to navigating you through these changes, ensuring a seamless transition while upholding the excellence of our services.

HOW THIS IMPACTS YOU

Disclosures

There will be a heightened emphasis on disclosures, especially when engaging in Multiple Representation scenarios.

Agency

The option for a customer relationship is no longer permissible. If someone prefers not to receive services from an agent, they have the choice to represent themselves.

OUR PLEDGE TO YOU

At The Olivera Group, your needs and aspirations have always been our top priority. These legislative changes provide us with an opportunity to reinforce our commitment to your success in the real estate market. Our team is extensively trained and continuously updated on these regulations to provide you with the most precise and effective guidance.

LOOKING AHEAD

The real estate industry is dynamic, and these changes are crucial for its growth and integrity. As these new regulations come into effect, we anticipate a period of adjustment. However, with our experienced team and dedication to staying ahead of industry developments, we are well-prepared to navigate these changes.

With The Olivera Group, you can confidently embark on your real estate journey, secure in the knowledge that you will receive professional guidance and support at every stage. Our objective remains unwavering: to assist you in achieving your real estate aspirations with trust, transparency, and unparalleled expertise.

Together, let's embrace these changes and continue building a thriving future in real estate.

Find out more about TRESA here: https://www.orea.com/TRESA

Read the RECO information guide here: TRESA GUIDE

Since the peak in 2022, Toronto's real estate market has encountered a period of adjustment. Notable developments during this timeframe include:

1. A decline in property values, followed by a stabilization leading to a lateral market movement, in line with typical seasonal trends.

2. A reduction in property transactions, intensifying the competitive landscape for real estate professionals.

3. An increase in property listings, empowering buyers with greater negotiating leverage.

4. A rise in distressed sellers, evidenced by the prevalence of power of sale listings.

The Greater Toronto Area (GTA) underwent significant changes in its housing landscape in 2023, particularly within the rental sector, due to persistent affordability challenges. Reduced home sales characterized the year, primarily attributed to elevated mortgage rates and stringent qualification criteria.

Highlights from the January release by the Toronto Regional Real Estate Board (TRREB) include:

1. A 12.1% decrease in home sales compared to 2022, with 65,982 sales reported.

2. The average selling price for all types of homes experienced a 5.4% decline from the previous year, settling at $1,126,604.

3. Increased demand for rental properties was observed, influenced by record levels of immigration.

In 2023, the GTA recorded fewer than 70,000 home sales, a figure reminiscent of 2008 when the realtor population was significantly smaller, resulting in a substantial reduction in transactions per realtor. Jennifer Pearce, TRREB's President, remains optimistic about 2024, anticipating a decline in borrowing costs and a resilient economic outlook, potentially fostering a rebound in home sales.

While concrete evidence supporting the economy's resilience is currently elusive, the decline in bond yields suggests a forthcoming reduction in borrowing costs, a typical precursor to an economic downturn. This challenges the assumption of a robust economic performance in the upcoming year.

There is a possibility that the months of December and January mark the nadir in transaction volume (not price) within this housing cycle, reflecting the lowest activity months at the conclusion of the least active year in decades. Consequently, a resurgence in home sales appears plausible.

While real estate professionals may see improved prospects as transactional activity rebounds, the outlook for sellers remains uncertain. The trajectory of housing prices appears contingent upon housing affordability, a multifaceted dynamic encompassing house prices, interest rates, income levels, and job stability. In essence, the resurgence in home purchases may only occur when affordability aligns, and current indicators suggest this milestone is yet to be reached.

The decline in Canada's housing market deepened in November, exacerbated by the cumulative impact of interest rate hikes affecting both buyers and sellers.

Recent data from the Canadian Real Estate Association (CREA) reveals a 0.9% month-over-month decrease in sales and a 1.1% drop in the MLS Home Price Index (HPI) for November.

Since the resumption of interest rate hikes by the Bank of Canada in June, sales have plummeted by nearly 13%, essentially erasing the rebound observed in the spring. Prices have experienced a continuous decline for three consecutive months, with November witnessing the most substantial drop in almost a year.

At a regional level, the MLS HPI recorded monthly declines of 1.7% in Ontario, 2% in Nova Scotia (the first decline since March), 0.9% in Manitoba, and 0.4% in British Columbia. Meanwhile, previous price gains have leveled off in Quebec and New Brunswick.

According to RBC's Robert Hogue, Assistant Chief Economist, and Rachel Battaglia, Economist, most major markets are now in a "correction mode." The anticipation is that persistently high interest rates will continue to suppress demand in the coming months, leading to further price reductions in the new year.

Even in Calgary, where prices increased by 1.2% on a monthly basis in November, analysts, including RBC, believe it is only a matter of time before softer market sentiments rein in those gains.

Economists like Robert Kavcic from BMO and Marc Desormeaux from Desjardins expect further price declines, noting that conditions in major markets are shifting in favor of buyers. However, Farah Omran, Senior Economist at Scotiabank, highlights that many potential buyers are looking ahead to 2024, anticipating interest rate cuts that may offset any short-term price declines.

Despite the caution observed in 2023, economists maintain their belief that the Bank of Canada will initiate interest rate cuts in 2024. They argue that the housing market and the broader Canadian economy are facing weakening conditions due to high interest rates, and with notable progress in reducing inflation, a shift toward rate cuts is anticipated by mid-next year.

If you have any questions or inquiries about the current real estate market, don't hesitate to reach out to us. We would be more than happy to provide insights and assistance. Feel free to send us an email at info@theoliveragroup.com or give us a call at 647 951 0850 for personalized guidance.

As the temperatures dropped, the Greater Toronto Area witnessed another month of declining home sales in November, as reported by the latest data from the Toronto Regional Real Estate Board (TRREB).

Last month, the GTA recorded 4,236 home sales, indicating an 8.8% decrease from October and a 6% dip compared to November 2022. When adjusted for seasonal variations, which typically lead to reduced activity in winter, the sales numbers showed a slight improvement from October, according to TRREB.

Throughout the year, factors such as high borrowing costs, economic uncertainty, and a persistent lack of affordability have hampered home sales, prompting prospective buyers to postpone their purchases until it makes more financial sense.

"Inflation and elevated borrowing costs have impacted affordability significantly," noted TRREB President Paul Baron. "Nowhere is this more evident than in the interest rate-sensitive housing market."

As sales declined, so did prices, with the average home price in the GTA dropping by 3.9% month over month to a new average of $1,082,179. This aligns with the average price observed in November 2022, showing minimal additional value gains for many homes over the past year. In Toronto, Ontario's busiest market, home prices fell by 6.8% month over month, accompanied by a 12.5% reduction in sales. The most substantial change was observed in Toronto's detached homes, where sales plummeted by 21.3%, and the average price decreased by over $100,000 to $1,617,918, down from $1,718,440.

"Home prices have adjusted in response to higher borrowing costs," explained TRREB Chief Market Analyst Jason Mercer. "This has provided some relief for buyers from an affordability perspective. As mortgage rates trend lower next year and the population continues to grow at a record pace, expect demand to increase relative to supply, leading to renewed growth in home prices."

Despite the overall decline, certain areas experienced minimal fluctuations in demand month over month. Halton Region, for instance, maintained nearly the same number of sales (increasing by only three), while its average price climbed by several thousand dollars to $1,208,950. Oakville, in particular, witnessed an average price rise from $1,395,752 to $1,572,012—a gain of nearly $200,000.

For those ready to make a home purchase now, there is a noticeable increase in the number of homes available compared to last year. Inventory levels received a substantial boost in November, with 10,545 new listings entering the market, bringing the total number of active listings to 16,759—a 40.7% surge from November 2022. However, with demand simmering below the surface among potential homeowners, TRREB CEO John DiMichele is urging governments to take more action, anticipating a growing housing demand "for years to come."

"We have seen some productive policy decisions recently that should help with housing affordability, including allowing existing insured mortgage holders to switch lenders without the stress test," said DiMichele. "Additionally, in the interest of household and economic stability, we continue to call on the Office of the Superintendent of Financial Institutions to apply the same approach to uninsured mortgages. It also goes without saying that further policy work is required to bring more supply online."

The recently released October Consumer Price Index (CPI) report for Canada has taken analysts by surprise, revealing milder inflation than expected at 3.1% year-on-year. This blog post delves into the key findings and implications of the report, highlighting critical factors shaping the economic outlook.

The October Consumer Price Index (CPI) reading turned out to be milder than anticipated, coming in at just 3.1% year-on-year (as opposed to the expected 3.2%). Notably, the headline index experienced a 0.1% month-on-month decline on a seasonally adjusted basis, marking the first monthly decrease since the onset of the pandemic in early 2020.

The primary factor contributing to the monthly decline was a 6% drop in gasoline prices. However, even when excluding this factor and examining core inflation, which the Bank of Canada closely monitors, there was a significant deceleration from 4.0% to 3.8%. With inflation falling, coupled with a softening labor market (a 0.7% rise in the unemployment rate over the past 6 months) and a weakening economic growth forecast (Q3 expected to be flat), it is highly probable that the Bank of Canada will maintain its current stance.

In fact, markets are currently factoring in a pause from the Bank of Canada only until the April meeting next year, before potential rate cuts commence. This is a notable shift, as earlier in the month, markets were not anticipating the first cut until the latter half of the following year. It would require substantial changes for the Bank of Canada to shift from its current "pause" mode, as the data does not support future interest rate hikes.

Governor Macklem emphasized the effectiveness of the current monetary policy in a recent speech, stating that interest rates may now be sufficiently restrictive to restore price stability. Despite such assertions, there is skepticism given the governor's past statements and the unpredictable nature of economic forecasting. The current outlook suggests that interest rates will remain low unless there are significant and unforeseen changes.

The pressing question now is when the Bank of Canada will decide to cut rates. As mentioned in the previous month's analysis, a crucial factor is the decline in inflation expectations, (to know more from the BoC click the link here). Until these expectations decrease to at least 3%, rate cuts are highly unlikely. Additionally, the Bank of Canada faces a dilemma, as cutting rates too aggressively compared to the Federal Reserve could impact the Canadian dollar and potentially lead to increased inflation through more expensive imports.

This situation is further complicated by the resilient nature of the U.S. consumer, who shows no signs of slowing down, benefiting from locked-in low rates for 30 years and lower overall debt burdens compared to Canadians. Ultimately, the actions of U.S. consumers may play a significant role in determining Canadian interest rates, irrespective of the state of the domestic economy—a somewhat unsettling prospect.

Examining the data closely reveals an uneven performance in the market for low-rise houses and condos across the five regions of the Greater Toronto Area (GTA). Similar to the varied performance of housing markets across Canada, as discussed in a recent interview with BMO's Robert Kavcic, different regions and types of houses within a metropolitan area also exhibit diverse trends.

In this month's data analysis, we will delve into how the market for low-rise houses and condos is faring across the GTA's five regions. The chart below illustrates the year-over-year change in sales for October 2023.

-560-wide.png)

Notably, condos in Peel experienced the most significant decline in sales, just under 20%, followed by houses in the Halton region with an 11% decrease. In contrast, condos in York are the only house type that has witnessed an increase in sales compared to last year.

A noteworthy observation is that most regions and house types saw sales volumes fluctuate within 5% of last year's levels. While the GTA experienced relatively soft sales last year, the substantial difference between this year and the last lies in the change in the number of homes available for sale or active listings.

Active listings across the GTA have surged by over 50% for all house types and regions, excluding a 38% decline in Halton condos. Suburban houses have witnessed the steepest increase in active listings, followed by condos in the City of Toronto.

-560-wide.png)

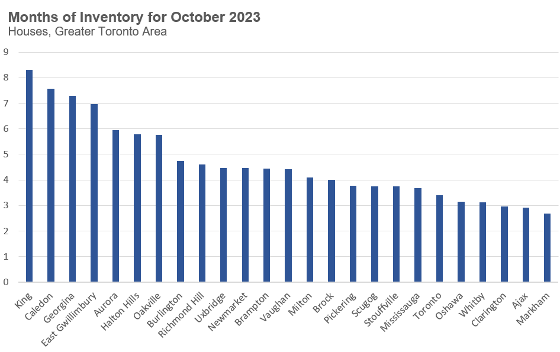

However, to comprehend the market balance in each area, it's crucial to examine the months of inventory (MOI).

-560-wide.png)

Despite Durham's houses seeing the most significant increase in active listings, it also boasts the lowest MOI, suggesting a more balanced and competitive market compared to other regions and house types.

Across all five regions, the condo market has a higher MOI than the house market, with the City of Toronto exhibiting the most significant difference between house types. Houses have a 3.4 MOI compared to condos at 5.8 MOI, indicating a slower condo market.

There is substantial variability in the MOI for houses across GTA municipalities. The chart below illustrates the October MOI for houses in each municipality. Far-reaching areas of the GTA, such as King, Caledon, Georgina, and East Gwillimbury, show a high MOI of 7 to 8, while areas closer to Toronto's east-end suburbs, including Oshawa, Whitby, Clarington, Ajax, and Markham, have around 3 MOI.

Considering how prices have changed over the last year, it's essential to note that GTA prices have been trending downward for the past four months. Therefore, regions and house types showing year-over-year price increases do not necessarily indicate current upward trends but rather reflect that despite declining prices since spring, they remain higher than last year.

Interestingly, despite the surge in active listings and record-low demand for houses, average prices are still up year-over-year in four of the five regions. The key takeaway for buyers and sellers is that market dynamics are highly localized, and relying on aggregate trends for the Greater Toronto Area may not provide accurate insights for real estate decisions.

Feel free to reach out to Ann or myself with any questions you may have. We're here and more than willing to help you make the most informed real estate decision that aligns with your current situation. Your inquiries are valued, and we're dedicated to ensuring your satisfaction throughout this crucial decision-making process.

The Greater Toronto real estate market has experienced a significant chill, driven by various factors that have led to a drop in home prices. Toronto Regional Real Estate Board (TRREB) data reveals a notable decline in the composite benchmark home price, with declining sales and an influx of new inventory being the primary contributors to this trend.

Home prices saw a sharp decline in October, with TRREB's benchmark price falling by 2.1% (equivalent to -$23,400), settling at $1,103,600. The City of Toronto witnessed an even steeper drop of 2.3% (-$24,900) in its benchmark price, reaching $1,083,700 during the same period. This decline marks the lowest price level since January 2023, erasing most of the gains made over the past year.

Year-over-year growth in both the TRREB (+1.42%) and City of Toronto (+0.3%) remained minimal, raising concerns of potential negative growth without significant shifts in inventory and sales trends. The residential real estate market in Greater Toronto is experiencing a notable softening in demand. In October, annual sales growth dipped by 5.8% to 4,646 homes, while new listings surged by 38% to reach 14,397 listings over the same timeframe.

This decline in sales, combined with the substantial increase in inventory, has shifted the industry's sales-to-new listings ratio (SNLR) to just 32%, signaling a "buyers' market" scenario and putting additional downward pressure on home prices. The decline in demand was largely anticipated as higher interest rates have deterred investor activity, and the market now faces the challenge of either reducing prices to accommodate end-user affordability or attracting investors back with more favorable borrowing terms.

The shift in market dynamics highlights the need for a delicate balance to stabilize the Greater Toronto real estate market and address the challenges it currently faces. As the market navigates changing conditions, it remains a crucial area to watch for prospective buyers, investors, and industry enthusiasts.

For comprehensive analysis and valuable insights regarding any future developments, be sure to stay connected with us for our ongoing real estate analyses and expert opinions.

The BoC's decision to keep interest rates unchanged for the second consecutive meeting is aimed at instilling confidence and preventing a resurgence of speculative behavior in the real estate market. However, it's clear from the BoC's language and the deteriorating economic conditions that further rate increases in this economic cycle are unlikely.

The Bank of Canada (BoC) opted to maintain its current interest rates during its latest meeting, marking the second consecutive meeting where rates remained unchanged. The decision to keep rates steady is aimed at reassuring the Canadian public about the potential for future rate hikes, with the goal of preventing a resurgence of speculative behavior in the real estate market. However, it is evident from the language used by the BoC and the worsening economic conditions that any further rate increases in this economic cycle are unlikely.

While it appears that we have reached the peak in terms of interest rates, the pressing question now is when we can expect to witness actual relief from the current economic challenges. The Bank of Canada continues to emphasize its commitment to a "higher for longer" economic environment.

Several key takeaways emerge from the BoC's latest statement. Firstly, the Bank acknowledges the mounting pressure that could potentially lead to a recession. It recognizes the increasing evidence that previous interest rate hikes have had a dampening effect on economic activity and have contributed to easing price pressures.

During the press conference, there was a notable remark about the narrow path to achieving a soft landing in the economy. The latest projections from the Bank suggest that this path has become even narrower, which can be seen as a cautious acknowledgment of the possibility of an impending recession. This sentiment aligns with the broader economic trends in Canada.

The evidence supporting concerns of a looming recession is substantial. One noteworthy example is the persistent negative trend in GDP when adjusted for Canada's rapidly growing population. In other words, in per capita terms, the country is already experiencing a recession. This data underscores the challenges Canada faces in maintaining economic stability in the face of adverse conditions. Secondly, it's crucial to closely monitor the decline in retail sales, as it serves as a pivotal macroeconomic indicator. When consumers start to pull back on their spending, the broader economy typically follows suit.

In the latest data, we observe a notable 0.6% decline in retail sales when adjusted for inflation, marking the lowest point reached in the entire year. The most significant areas of weakness are evident in the cyclical sectors, including automobiles, home furnishings, clothing, sporting goods, and hobby stores, all of which experienced declines last month. This trend aligns with what one would anticipate as the economy undergoes a cooling phase.

When we examine sales on a per capita basis, they still register negative year-on-year figures, even before factoring in the effects of inflation. This particular aspect of the data further underscores the possibility of a looming recession. It implies that consumer spending is not only retreating but also losing its real purchasing power, potentially indicating a recessionary environment. Consumers are now encountering a substantial obstacle, a sentiment that is notably reflected in the most recent consumer confidence indices. To underscore the gravity of the situation, it's worth noting that in the two-decade existence of the Conference Board's index, it has ventured below the 60-point threshold on only five occasions. This threshold is an important marker, as it typically indicates a pronounced shift in consumer sentiment.

Historically, this index dipped below 60 during the global Financial Crisis, experienced a brief stint in April 2020 amid the initial shockwaves of the pandemic, and now, in September and October of 2023, it has again fallen below this critical threshold. However, what makes this recent development especially noteworthy is the fact that, in its entire history, this index had never consecutively registered readings below 60 until these past two months. This prolonged dip signifies a prolonged period of wavering consumer confidence, which can have far-reaching implications for the overall economic landscape. The sentiment of gloom is not exclusive to consumers; it extends to the business sector as well. The Conference Board of Canada's Index of Business Confidence has experienced a significant decline for the ninth consecutive quarter. Presently, it has descended to levels that have only been witnessed twice in the last two decades, notably during the Financial Crisis and the onset of the COVID pandemic.

This persistent and deepening decline in business confidence is an alarming trend, reflecting the prevailing uncertainty and apprehension within the corporate landscape. An especially telling statistic is that nearly 60% of companies now anticipate deteriorating economic conditions over the next six months. This figure represents a substantial increase from the 39.5% recorded in July, highlighting the growing pessimism within the business community. This shift in outlook suggests a considerable shift in the perception of future economic prospects, which could have significant repercussions on business decisions and overall economic performance. Indicators signaling future sales have now plummeted to levels not witnessed in the past two decades, with the exception of periods marked by recessions. Additionally, a growing proportion of companies are identifying sales and demand-related issues as significant concerns in their operations.

When both consumers and businesses experience a decline in confidence, it invariably leads to reduced consumer spending and decreased investment in business activities. Recognizing this, the Bank of Canada (BoC) has rightfully adopted a cautious stance against tightening monetary policy further, given the evident deterioration in the overall macroeconomic environment.

Some readers may understandably point to the relatively robust labor market as a counterargument. However, it's crucial to bear in mind that job market conditions tend to be among the last factors to exhibit a downturn in response to economic challenges. This observation holds especially true following several years marked by an almost desperate demand for workers, during which businesses clung to their workforce assets until they had no other viable option. Yet, it is increasingly apparent that the time for significant changes in the labor market is approaching.

In a surprising turn of events, Canada witnessed a slowdown in its annual inflation rate in September, leading to expectations that the Bank of Canada (BoC) will not raise interest rates on October 25. This article dives into the details of this development and its potential implications.

The most recent Consumer Price Index (CPI) data from Statistics Canada reveals that inflation increased by 3.8% year over year in September, a decrease from the 4% recorded in August. This deceleration in inflation was widespread and primarily attributed to reduced prices in specific categories.

Grocery prices played a significant role in the inflation slowdown. In September, they saw a year-over-year increase of 5.8%, down from a 6.9% rise in August. This was mainly driven by a slowdown in the cost of items like meat, dairy products, coffee, and tea.

Durable goods also experienced a more modest annual increase of 0.4% in September, compared to the 1.4% surge in August. Additionally, the price of air transportation plummeted by 21.1% in September, contributing to the overall slowdown.

Offsetting the deceleration in the overall CPI was an increase in gasoline prices, which rose by 7.5% annually due to base-year effects. However, on a monthly basis, gas prices fell by 1.3%, playing a significant role in the 0.1% month-over-month decline in the CPI.

The CPI median and CPI trim, the Bank of Canada's preferred measures of core inflation, also decelerated to 3.8% and 3.7%, respectively, on an annual basis in September. On a three-month annualized basis, CPI median fell to 3.5%, while CPI trim eased to 3.8%.

Despite inflation remaining notably above the Bank of Canada's 2% target, September's inflation figure fell short of economists' expectations. Alongside signs of a slowing economy, such as a lackluster Business Outlook Survey and stagnant GDP, economists anticipate that the Bank will, for the second consecutive month, choose to keep interest rates steady at 5%.

Benjamin Reitzes, Managing Director at BMO, expressed that "inflation is currently uncomfortably high, but the trend favors the Bank of Canada." He emphasized that, given the lagging nature of inflation indicators and the weakening economy, there appears to be no immediate need for further rate hikes.

Marc Ercolao, an Economist at TD, concurred with the expectation of the Bank of Canada maintaining its current rates, stating that September's data marks "another small step toward addressing the remaining inflation concerns."

However, Randall Bartlett, Senior Director of Canadian Economics at Desjardins, cautioned that the Bank of Canada's announcement might include a "hawkish tone" and a "threat to raise interest rates again if data does not cooperate." This stance would align with Bank of Canada Governor Tiff Macklem's remarks in September.

Macklem pondered, "The focal point for the governing council will be whether to retain the policy rate at 5.00% and allow past interest rate increases to have their intended impact on the economy and alleviate price pressures. Alternatively, does the weight of evidence from various economic indicators suggest that further action is required to restore price stability?"

Canada's recent inflation figures have surprised economists, and all eyes are on the Bank of Canada's upcoming decision regarding interest rates. While inflation remains high, the signs of a weakening economy suggest that the BoC may opt to keep rates steady for the second consecutive month. However, there's a hint of caution in the air, as the central bank may adopt a more hawkish tone, keeping a close watch on inflation and the broader economic indicators. Stay tuned for the October 25 announcement to see how the BoC responds to these shifting economic dynamics.

When it comes to the real estate market in the Greater Toronto Area (GTA), there's a lot to consider. The impact of high borrowing costs, rising inflation, uncertainty regarding the Bank of Canada's future decisions, and slower economic growth have all played a role in shaping the GTA's real estate landscape. In this blog post, we'll explore the current state of the GTA real estate market, what the experts are saying, and how you can navigate this shifting environment.

In September 2023, the GTA real estate market faced some challenges, with home sales experiencing a 7.1% decline compared to September 2022. This dip was particularly noticeable in the sales of ground-oriented properties, including semi-detached houses and townhouses. Additionally, on a month-over-month seasonally-adjusted basis, sales saw a slight decrease.

Despite the drop in sales, there was good news for potential buyers. New listings were up significantly compared to September 2022, which had seen an exceptionally low number of listings. Furthermore, the number of listings continued to trend upward on a month-over-month seasonally adjusted basis.

For those who are concerned about affordability, the MLS® Home Price Index (HPI) Composite benchmark showed a year-over-year increase of 2.4%. The average selling price also saw a three percent rise over the same period. On a month-over-month seasonally-adjusted basis, both the average selling price and the MLS® HPI Composite benchmark showed a minor decrease of less than one percent.

TRREB President Paul Baron provided insights into the short and medium-term outlook for the GTA housing market. While borrowing costs are expected to remain high until mid-2024, there's a consensus that they will gradually decrease afterward. This suggests that the second half of the following year could see a notable uptick in demand for ownership housing. Lower interest rates and a growing population are expected to drive this increase in buyers.

One noteworthy challenge is the affordability for first-time buyers. TRREB's annual consumer polling indicates that approximately half of prospective homebuyers in Toronto are first-time buyers each year. However, the average price of a condo apartment in Toronto now exceeds $700,000. Despite this, the first-time buyer exemption threshold for the City's upfront land transfer tax has remained at $400,000 for fifteen years.

TRREB CEO John DiMichele commended the Toronto City Council for requesting a report on a more appropriate exemption level. He stressed the importance of aligning housing and taxation policies to address the ongoing housing crisis.

As the GTA's real estate market faces various challenges, it's essential to stay informed and be aware of both short-term and long-term trends. While high borrowing costs and economic uncertainties pose challenges, there are opportunities for buyers, especially in the second half of 2024 when interest rates are expected to trend lower.

Moreover, advocacy for policy changes, like updating exemption thresholds to make housing more accessible, is crucial to ensuring a fair and balanced real estate market in the GTA. With all these factors in mind, prospective buyers and sellers should stay informed and consult with experts to make well-informed decisions in this ever-evolving market.

We've just received the latest GDP data for both Canada and the United States, and in this blog post, we'll dive into how these figures might affect mortgage rates in the near term. Additionally, we'll explore the challenges posed by the mortgage stress test in Canada and the pressing issues facing Canadian mortgage borrowers.

Last week, Statistics Canada confirmed that our Gross Domestic Product (GDP) displayed no growth in July, following a 0.2% decline in June. Moreover, the estimate for August indicated a meager 0.1% expansion in our economy. These statistics prompted adjustments in the bond futures market, leading to reduced expectations of another interest rate hike by the Bank of Canada (BoC) this year. This trend aligns with the market's sensitivity to economic data releases.

The sluggish momentum in our GDP growth underscores the impact of the BoC's previous interest rate hikes, which are now becoming discernible. It also suggests that the savings buffers created during the pandemic, enabling consumers to manage higher costs while maintaining spending, are gradually depleting.

However, it's essential to note that sluggish economic growth alone won't suffice to bring inflation back in line with the BoC's 2% target. The overarching theme is that we have a considerable distance to cover before reaching that objective.

In stark contrast, recent data reveals that the United States achieved a year-over-year GDP growth rate of 2.1% in the second quarter. The US economy is currently operating at a significantly more robust pace compared to Canada, driven by two key factors:

1. Productivity Surge: Productivity in the United States has shown remarkable improvement since the pandemic began, whereas Canadian productivity has steadily declined during the same period. The significance of this measure, particularly over the long term, cannot be overstated.

2. Household Debt Discrepancy: During the 2008 Great Recession, US households substantially reduced their debt levels, while Canadian households continued to accumulate debt, as indicated in the chart. This divergence in household debt-to-GDP ratios suggests that the US consumer may be less sensitive to interest rate hikes, potentially causing the US Federal Reserve to maintain higher policy rates for a more extended period than the BoC. This scenario could have repercussions on Canadian fixed-mortgage rates.

Fixed mortgage rates in Canada are heavily influenced by Government of Canada (GoC) bond yields, often moving in tandem with their US counterparts. This synchronization may keep Canadian fixed mortgage rates elevated, even amid a weakening domestic economy.

Conversely, variable mortgage rates in Canada are not subject to the same constraints. They adjust in line with the BoC's policy rate, providing a more accurate reflection of domestic economic conditions.

As our economy decelerates and our housing markets cool down, it's time to reconsider some established practices. One such practice under scrutiny is the 2% inflation target. Some argue that this target is arbitrary and that a slightly higher target, around 3%, might be more suitable in the future.

The mortgage stress test is another policy tool under scrutiny given the evolving circumstances. While it made sense to qualify borrowers at rates close to long-term averages when mortgage rates were exceptionally low, the situation has changed. Mortgage rates have climbed above historical averages, and the BoC's policy rate remains in restrictive territory. The question arises: Is it still appropriate to qualify borrowers at rates 2% higher than their already elevated current levels?

While an immediate change to the stress-test rate isn't advocated, policymakers must navigate the housing market's momentum to combat inflation. There's also the issue of excess leverage in certain regional markets that heated up during the pandemic. However, the debate about reducing or altering the stress test will likely intensify, perhaps sooner than anticipated.

A notable flaw in our banking regulator's mortgage rules is the requirement for renewing borrowers switching to a different lender at renewal. They must be requalified at today's stress-tested rates, unlike borrowers who renew with their existing lender.

Initially designed to prevent excessive competition among lenders for highly leveraged borrowers, this policy inadvertently traps many borrowers with their existing lenders. This often forces them to renew at inflated rates. Despite criticism, the regulator has yet to address this anti-competitive policy and its impact on borrowing costs.

With today's stress-test rates exceeding 8%, more borrowers are unable to access competitive rates. This should increase pressure on our regulator to rectify this issue.

While the five-year GoC bond yield showed minimal changes recently, a mid-week surge in bond yields led to further increases in fixed mortgage rates. Predicting when fixed rates will stabilize is challenging due to the strong upward momentum in bond yields. Therefore, those seeking a mortgage are advised to secure the best available rate today, as even a seemingly less favorable pre-approval rate could become highly competitive in the near future.

Variable-rate discounts have remained unchanged, and although the consensus suggests the BoC may have completed its rate hikes for 2023, uncertainty persists. The bond futures market's volatility, coupled with forthcoming employment reports from both the US and Canada, could trigger additional rate fluctuations.